Emory university geteducated.

Emory university hospital: 404-712-1863. emory university hospital midtown: 404-686-2482. emory saint joseph hospital: 678-843-7303. your health record includes your medical history such as allergies, medicines and test results, as well. Claiming medical expenses as a deduction on your income taxes will lessen your tax liability if you meet certain restrictions placed by the internal revenue service. to deduct medical expenses, you will have to itemize your deductions. if t. You can claim mileage on your income taxes if it fits within the internal revenue service rules. if you are a business owner, you can claim mileage as a business expense. others can only claim ita for charity, medical and job related expens. Mileage can be used as a tax deduction for taxpayers that choose not to deduct the operating expenses required for their vehicle during the tax year. mileage rates change yearly and are different for each type of business you conduct, such.

Medical Records Emory Healthcare

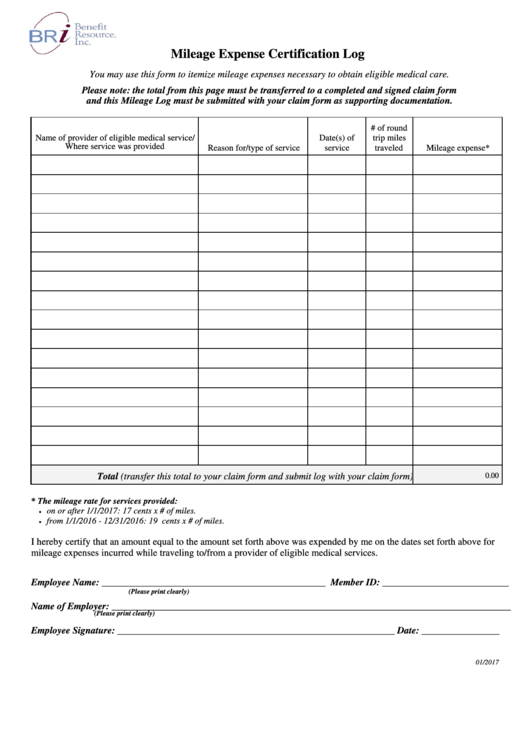

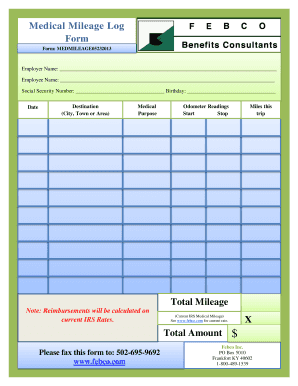

You can also learn more from the irs website. medical mileage log requirements. like with business miles, the irs doesn’t just take your word for your medical miles. you need documentation of these trips in the form of a mileage log. your mileage log should include a record of: your mileage; the dates of your medical trips. 57. 5 cents per mile driven for business use, down one half of a cent from the rate for 2019, 17 cents per mile driven for medical or moving purposes, down three cents from the rate for 2019, and. 14 cents per mile driven in service of charitable organizations. Medical mileage can save you money when you file your income tax return as part of the medical expenses deduction. however, the medical deduction rules have thresholds you have to meet before you can deduct any of your health care costs, so.

Windermere Medical Group Primary Care Windermere Medical

Ctca atlanta uses advanced treatments to fight cancer. at our georgia cancer hospital, you'll receive leading-edge therapies and supportive care. call us 24/7 at cancer treatment centers of america® (ctca), atlanta, you'll find comprehensiv. Attn: him department. 1550 litton drive stone mountain, ga 30083. phone: 404-778-4088. the emory clinic-email address is: intake@cioxhealth. com (this number must be placed in the subject line of the email: 50195; nothing should be placed in the body of the email) emory university orthopaedics & spine hospital. Medical records view medical records; website issues or questions please email webadmin@emoryhealthcare. org. contact our nurses. to help you navigate the emory healthcare network, we have set up a direct line to registered nurses and representatives who can answer almost any question you might have regarding health information. Medical driving and medical mileage deduction. we’ve mentioned the agi rate, but the medical mileage deduction rate is something completely different. you medical mileage log for taxes are entitled to 16 cents/mile for medical or moving purposes. the rate went down by 4 cents from last year. final words. medical mileage deductions are not to be ignored.

Free Excel Mileage Log Template For Taxes Microsoft Com

Records management at emory. emory university supports the consistent, efficient, and comprehensive management, retention, and disposition of its records. the information provided on this site enables departments to fulfill that work. The internal revenue service provides medical mileage log for taxes tax filers with two methods of claiming expenses associated with the use of an automobile as a tax deduction. the actual expense method allows for the deduction of gas, insurance, license fees, tags and.

Emory university orthopaedics and spine hospital has applied to the american nurses credentialing center (ancc) for the prestigious designation of magnet. patients, family members, staff and interested parties who would like to provide comments are encouraged to medical mileage log for taxes do so.

Medical Records L Billing Insurance And Medical Records L

As the old adage goes, taxes are a fact of life. and the more we know about them as adults the easier our finances become. there are many things to learn to become an expert (this is why we have accountants), but the essentials actually are. A mileage log serves as proof and may also be used to keep track of other deductible miles, e. g. those traveled for medical, charitable or moving purposes. to deduct miles on your tax return, you need to keep meticulous and accurate records of your driving on a daily basis in case of an irs audit. The following table summarizes the optional standard mileage rates for employees, self-employed. Michael c. carlos museum, emory university: michael c. carlos museum, emory university 571 south kilgo circle, ne atlanta, ga 30322. miller county (probate court) 155 south first street, room 110 colquitt, ga 39837. miller county health department (covid vaccine) miller : 250 west pine street colquitt, ga 39837-3532. mitchell county (probate court).

The mailing address is: emory university student health services, attn: medical records, 1525 clifton rd, atlanta, ga 30322. the fax number is: 404-727-5349. to submit this request electronically, attach a completed pdf version of the release form to medicalrecords-shs@emory. edu. Emory university hospital: 404-712-1863. emory university hospital midtown: 404-686-2482. emory saint joseph hospital: 678-843-7303. your health record includes your medical history such as allergies, medicines and test results, as well as, health insurance information and how to contact you.

By november 1922, the hospital had grown too large for its quarters and moved to its current dekalb county site on the emory university campus. the new 275-bed facility was a gift of asa g. candler, philanthropist and founder of the coca-cola company. in the mid-1930s, our name was changed to emory university hospital. You can use the following log as documentation for your mileage deduction. for 2020, the irs lets you deduct 57. 5 cents per business mile. this template will calculate the value of your business trips based on this figure. when tax time rolls around, you can use this mileage template to determine your deduction on your schedule c tax form. what you need in your mileage log. the mileage deduction can save you thousands on your taxes. but, the irs won’t just take you at your word for how.

When it comes to income taxes, every deduction is important; especially if you’re self-employed. however, mileage can also be deducted for medical trips and charitable services if you meet certain qualifications. when it comes to income tax. Emory healthcare website at www. emoryhealthcare. org and following these steps: click on the “medical records” link at bottom of page. click on the “electronic request for records” link. upon creating an account, you will have the ability to request your records electronically and receive them electronically.

The internal revenue service allows you to deduct expenses you incur while conducting business, including any vehicle expenses you run up. because fraud is common in vehicle expense claims, the irs wants to be sure all expenses claimed are. Your private medical record is not as private as you may think. here are the people and organizations that can access it and how they use your data. in the united states, most people believe that health insurance portability and accountabil. Did you make medically necessary home modifications? if so, you may be entitled to some federal tax deductions. here are the tax deduction details. you might be able to claim tax deductions for home improvements made for medical reasons if.

She is a member of international association for physicians in aesthetic medicine. she started windermere medical group to achieve her goal to be a community physician for all primary health care needs medical mileage log for taxes for families. during her career, she worked for va clinic and served as part-time faculty member at emory university school of medicine. The internal revenue service spares taxpayers the time and effort of calculating all their car expenses for the year and then prorating them among the different reasons they used the car by allowing a standard mileage rate. the internal rev.